UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended December 31, 2021

(Exact name of registrant as specified in its charter)

CALIBERCOS INC.

Commission File Number: 024-11016

| Delaware | 47-2426901 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S Employer Identification No.) |

| 8901 E Mountain View Rd., Ste 150 Scottsdale, AZ (Address of principal executive offices) |

85258 (Zip Code) |

(480) 295-7600

Registrant’s telephone number, including area code

Series B Preferred Stock

(Title of each class of securities issued pursuant to Regulation A)

Explanatory Note

In this report, the term “Caliber”, “we”, “us”, “our” or “the Company” refers to CaliberCos Inc.

This annual report on Form 1-K may contain forward-looking statements that are based on our beliefs and assumptions and on information currently available to us. Forward-looking statements include information related to the expected effects on our business of COVID-19 pandemic (“the pandemic” or “COVID-19”), possible or assumed future results of operations and expenses, business strategies and plans, competitive position, business environment, and potential growth opportunities. Forward-looking statements include all statements that are not historical facts. In some cases, forward-looking statements can be identified by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would,” or similar expressions and the negatives of those terms.

These forward-looking statements are based on our current assumptions, expectations, and beliefs and are subject to substantial risks, estimates, assumptions, uncertainties, and changes in circumstances that may cause our actual results, performance, or achievements to differ materially from those expressed or implied in any forward-looking statement, including, among others, the profitability of the business. Risks that could affect our results of operations, liquidity and capital resources, and other aspects of our business discussed in this Report include the duration and scope of COVID-19, including whether, where and to what extent resurgences of the virus occur; its short and long-term impact on the broader economy, levels of consumer confidence, and government actions taken in response to the pandemic. These statements reflect management’s current views with respect to future events and are subject to unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Given these uncertainties, you should not place undue reliance on any forward-looking statements in this report. COVID-19, and the volatile economic conditions stemming from it, and additional or unforeseen effects from the pandemic, could also give rise to or aggravate the other risk factors that we identify under the heading “Risk Factors” contained in our Offering Circular approved by the SEC on June 22, 2020, which in turn could materially affect our business, financial condition, liquidity, and results of operations (including revenues and profitability).

These developments have had a material adverse impact on the Company’s revenues, results of operations and cash flows for each of fiscal 2021 and 2020. The situation is continually changing and additional impacts to the business may arise that we are not aware of currently. While certain restrictions in the state of Arizona have begun to be rescinded, we cannot accurately predict whether that trend will continue in all of our markets and when or the manner in which the conditions surrounding the pandemic will change, including the timing of lifting any additional local or national restrictions, how or when business and leisure travel will return to pre-pandemic levels and at what velocity, how investor sentiment and demand will be affected toward the perceived risks and returns required to participate in real estate investments, the duration and impact of the CDC’s agency order titled ‘Temporary Halt in Residential Evictions to Prevent the Further Spread of COVID-19’ (the ‘eviction moratorium’), or whether or not the impact of the pandemic will have a permanent and lasting effect on real estate values.

Any forward-looking statement made by us in this report speaks only as of the date on which it is made. Except as required by law, we disclaim any obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

| 2 |

TABLE OF CONTENTS

| 3 |

General

Caliber is a leading vertically integrated asset management firm, whose primary goal is to enhance the wealth of investors seeking to make investments in middle-market assets. As of December 31, 2021, we had total assets under management, as defined hereunder, “AUM”, with a fair value of approximately $615 million. “Assets Under Management” refers to those assets we manage and from which we derive management fees, performance revenues and other fees and expense reimbursements. We build wealth for our investor clients by creating, managing, and servicing proprietary products including middle-market investment funds, private syndications, and direct investments. Our funds include investment vehicles focused primarily on real estate, private equity, and debt facilities. We earn asset management fees calculated as a percentage of managed capital in our Funds and Offerings. We market our services through direct sales to private investors, marketing to investment advisers, and in-house client services. Our internal marketing team includes public and government relations.

We believe that we provide investors attractive risk-adjusted returns by offering a balance of (i) structured offerings and ease of ownership, (ii) a pipeline of investments opportunities, primarily projects that range in value between $5 million-$50 million, and (iii) an integrated execution and processing platform. Our investment strategy leverages the local market intelligence and real-time data we gain from our operations to evaluate current investments, generate proprietary transaction flow, and implement various asset management strategies.

Caliber’s Integrated Model

While we primarily act as an alternative asset manager, we also offer a full suite of support services and employ a vertically integrated approach to investment management. Our asset management activities are complemented with transaction and advisory services including development and construction management, acquisition and disposition expertise, and capital formation, which we believe differentiate us from other asset management firms. We believe our model allows us to acquire attractive projects, reduce operating costs and deliver services to our funds that bolster net returns to investors. We integrate our deep expertise and knowledge across these verticals to successfully manage our investment platform.

We follow a rigorous diligence process to identify and qualify each of our investments. We source and analyze our investment opportunities through the strong relationships and networks we have developed in our target markets. We utilize and consider both qualitative and quantitative data in the identification and selection of our investment opportunities. We consider data from varying sources including proprietary market analytics to internal financial modelling. We layer on top of the quantitative factors our insights behind the numbers and present that information and guidance to an internal investment committee which brings together various senior representatives from across the Caliber ecosystem to advocate for their respective constituencies. Finally, we also consider portfolio exposure or concentrations in any one asset class and other laws and requirements that are either outlined in our fund operating agreements or other limitations required by law.

Real Estate – Our real estate expertise was formed in the wake of the 2008 financial crisis and encompasses hospitality, residential, and commercial asset types and vertical and horizontal projects. Our asset management team specializes by asset type, allowing for collaboration of different real estate verticals to gain pricing and capital deployment efficiencies as well purchasing power over materials and supplies to increase cash flows and returns. Our real estate products include: core plus, value add, distressed and opportunistic investing. Our opportunity zone fund also provides access to tax efficient deployment of capital.

Credit – Our credit products are designed to meet our investors’ needs for stable, cash flowing, real estate agnostic investments. We deploy and enhance investing in both mezzanine and preferred equity strategies based on the capital requirements of the underlying investment. Each investment decision involves a number of factors and criteria which are focused on the subject asset’s ability to perform in the near term, its plans and projected capabilities, and its long-term return profile, among others.

Assets Under Management. AUM refers to the assets we manage or sponsor. We monitor two types of information with regard to our AUM:

| i. | Capital AUM – we define this as the total debt and equity capital raised from accredited investors in our funds at any point in time. We use this information to monitor, among other things, the amount of ‘preferred return’ that would be paid at the time of a distribution. As our asset management fees are based on a percentage of capital raised, Capital AUM provides relevant data points for management to further calculate and predict future earnings. |

| ii. | Fair Value (“FV”) AUM – we define this is as the aggregate fair value of the real estate assets we manage. We value these assets quarterly to help make sale and hold decisions and to evaluate whether an existing asset would benefit from refinancing or recapitalization. This also gives us insight into the value of our carried interest at any point in time. We also utilize FV AUM to predict the percentage of our portfolio which may need development services in a given year, fund management services (such as refinance), and brokerage services. As we control the decision to hire for these services, our service income is generally predictable based upon our current portfolio AUM and our expectations for AUM growth in the year forecasted. |

| 4 |

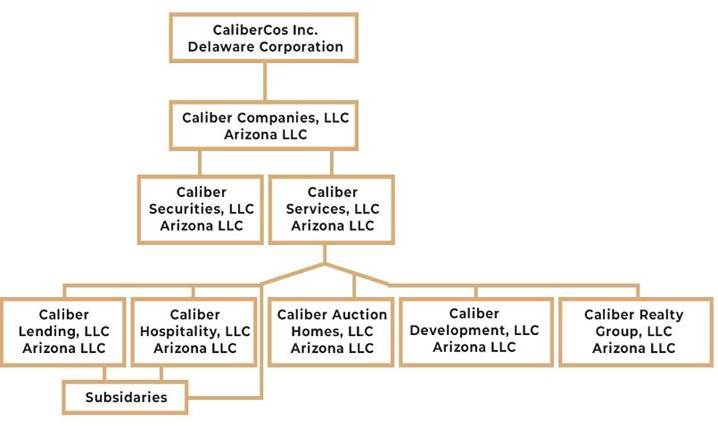

Caliber is organized as follows:

Business Segments

Our operations are organized into three reportable segments for management and financial reporting purposes: Fund Management, Development, and Brokerage.

| 5 |

Fund Management — This segment represents our fund management activities along with back office and corporate support functions including accounting and human resources. It includes the activities of Caliber Services, LLC and its subsidiaries, (“Caliber Services”), who acts as an external manager of our funds, which have diversified investment objectives. It also includes the activities associated with Caliber Securities, LLC (“Caliber Securities”), a wholly-owned Arizona registered issuer-dealer, which generates fees from capital raising. We earn fund management fees for services rendered to each of the funds by Caliber Services as follows:

| • | Asset Management Fee. We receive an annual asset management fee equal to 1.0% - 1.5% of the non-affiliated capital contributions related to the ongoing management of the assets owned by the fund and the overall fund administration. The management fees are payable regularly, generally monthly, pursuant to our management agreement with each fund. |

| • |

Carried Interest. We are entitled to an allocation of the income allocable to the limited partners or members of each fund for returns above accumulated and unpaid priority preferred returns and repayment of preferred capital contributions (the “Hurdle Rate”). Income earned with respect to our carried interest is recorded as Performance Allocations. Performance Allocations are an important element of our business and have historically accounted for a material portion of our revenues.

We typically receive a carried interest of 20% - 35%, depending on the fund, of all cash distributions from (i) the operating cash flow of each fund above the Hurdle Rate and (ii) the cash flow resulting from the sale or refinancing of any investments held by our funds after payment of the related fund’s investors unpaid priority preferred returns and Hurdle Rate. Our funds’ preferred returns range from 6% - 12%. |

| • | Financing Fee. We earn a fee upon the closing of a loan by our investment funds with a third-party lender. This is typically a fixed fee arrangement which approximates no more than 1% of the total loan and will not exceed 3% of the total loan after considering all other origination fees charged by lenders and brokers involved in the transaction. Financing fees are recorded under Transaction and Advisory Fees. |

| • | Set-Up Fee. We charge an initial one-time fee related to the initial formation, administration and set-up of the applicable fund. Set-up fees can be flat fees or a percentage of capital raised, typically 1.5% of capital raised or less. These fees are also known as Organizational and Offering expenses and are recorded under Transaction and Advisory Fees. | |

| • |

Capital Formation Fee. Through Caliber Securities, we earn non-affiliated fees from raising capital for our funds. Our contracts with our funds are typically fixed fee arrangements which approximate no more than 3.5% on capital raised. These fees are recorded under Transaction and Advisory Fees.

Based on the contractual terms of the relevant funds we manage, in addition to the fees noted above, Caliber is entitled to be reimbursed its expenses, that are not to exceed non-affiliated third-party costs, related to services provided to the funds. |

Development — This segment represents our activities associated with managing and supervising third party general contractors in the remodeling, refurbishing and ground-up construction of the properties owned by our funds. Revenues generated by this segment are generally based on 4% of the total expected costs of the project. Caliber Development, LLC (“Caliber Development”), a wholly-owned subsidiary of Caliber Services, acts as either the construction or development manager on our funds’ projects.

Brokerage — This segment is involved in the buying and selling of all our funds’ assets. For the years ended December 31, 2021 and 2020, our brokerage segment completed approximately $55.2 million and $5.6 million in transactions generating approximately $0.9 million and $0.1 million of brokerage fees, respectively.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Segment Analysis” for a discussion of activities by segment for the year ended December 31, 2021.

Structure of Funds

We are focused on enhancing wealth for our clients by providing access to high quality alternative investments. We believe that capital organized privately into structured funds offers investors an attractive balance of risk-adjusted return and investment performance. By allowing minimum investments as low as $35,000, we provide investors, who may not otherwise have been able to purchase a large asset, a variety of sophisticated alternative investment strategies, including typical real estate investment solutions.

Our funds are typically structured as limited partnerships or limited liability companies which have a specified period during which clients can subscribe for limited partnership units or membership interests in the funds. Once the client is admitted as limited partner or member, that client generally cannot withdraw their investment and may be required to contribute additional capital if called by the general partner or managing member. These funds can have a single investment purpose or the ability to invest in a broad range of asset types. As funds liquidate their investments, they typically distribute the proceeds to the funds’ investors, however, and in particular with our multi-asset funds, the funds have the ability to retain the proceeds to make additional investments.

We act as an external manager of our funds, which have diversified investment objectives and include investment vehicles focused on real estate, private equity and debt facilities. The consolidated investment funds are variable interest entities in which Caliber was determined to be the primary beneficiary since we have the power to direct the activities of the entities and the right to absorb losses, generally in the form of guarantees of indebtedness that are significant to the individual investment funds. Our chief operating decision maker does not regularly review the operating results of these investment funds for the purpose of allocating resources, assessing performance or determining whether additional investments or advances be made to these funds. Outside of our interests as the manager or general partner of these funds, our benefits in these entities are limited to Caliber’s direct membership or partnership interests, if any. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies and Estimates” for discussion of our consolidation and segment accounting policies.

| 6 |

Investment Process and Risk Management

We maintain a rigorous investment process across all our funds. Each fund has investment policies and procedures that generally contain investment parameters and requirements, such as limitations relating to the types of assets, industries or geographic regions in which the fund will invest. An investment committee reviews and evaluates investment opportunities in a framework that includes a qualitative and quantitative assessment of the key opportunities and risks of investments.

Our investment professionals are responsible for the full life cycle of an investment, from evaluation, through execution, to exit. Investment professionals generally submit investment opportunities for review and approval by the investment committee. The investment committee is comprised of executives and senior leaders of the company. When evaluating investment opportunities, the investment committee may consider, without limitation and depending on the nature of the investment and its strategy, the quality of the asset in which the fund proposes to invest, likely exit strategies, factors that could reduce the value of the asset at exit, and a range of economic and interest rate environments, macroeconomic trends in the relevant geographic region or industry and the quality of the asset’s business operations. Our investment committee also incorporates, to the extent appropriate, environmental, social and governance (“ESG”) factors into the investment decision-making process.

Existing investments are reviewed and monitored on a regular basis by investment and asset management professionals. In addition, our investment professionals and asset managers work directly with our portfolio companies’ directors, executives and managers to drive operational efficiencies and growth.

Capital Invested In and Alongside Our Investment Funds

To further align our interests with those of investors in our investment funds, we have invested our own capital and that of certain of our personnel in the investment funds we sponsor and manage. Minimum general partner capital commitments to our investment funds are determined separately with respect to each of our investment funds and, generally, are less than 5% of the limited partner commitments of any particular fund. We determine whether to make general partner capital commitments to our funds in excess of the minimum required commitments based on, among other things, our anticipated liquidity, working capital and other capital needs.

Investors in many of our funds also receive the opportunity to make additional “co-investments” with the investment funds. Our employees, as well as Caliber itself, also have the opportunity to make investments, in or alongside our funds and other vehicles we manage, in some instances without being subject to management fees, carried interest or incentive fees. In certain cases, limited partner investors may pay additional management fees or carried interest in connection with such co-investments.

Competition

The asset management industry is intensely competitive, and we expect it to remain so. We compete primarily on a regional, industry and asset basis.

We face competition both in the pursuit of fund investors and investment opportunities. Generally, our competition varies across business lines, geographies, and financial markets. We compete for outside investors based on a variety of factors, including investment performance, investor perception of investment managers’ drive, focus and alignment of interest, quality of service provided to and duration of relationship with investors, business reputation, and the level of fees and expenses charged for services.

We compete for investment opportunities based on a variety of factors, including breadth of market coverage and relationships, access to capital, transaction execution skills, the range of products and services offered, innovation, and price.

We compete with real estate funds, specialized funds, hedge fund sponsors, financial institutions, private equity funds, corporate buyers, and other parties. Many of these competitors are substantially larger and have considerably greater financial, technical, and marketing resources than are available to us. Many of these competitors have similar investment objectives to us, which may create additional competition for investment opportunities. Some of these competitors may also have a lower cost of capital and access to funding sources that are not available to us, which may create competitive disadvantages for us with respect to investment opportunities. In addition, some of these competitors may have higher risk tolerances, different risk assessments or lower return thresholds, which could allow them to consider a wider variety of investments and to bid more aggressively than us for investments that we want to make. Corporate buyers may be able to achieve synergistic cost savings with regard to an investment that may provide them with a competitive advantage in bidding for an investment.

| 7 |

The alternative investment industry is highly competitive. Many of our competitors have greater financial resources and a broader market presence than we do. We compete with respect to:

| • | Competitive fee structures on our asset management services; and |

| • | Diversification of our revenue stream across the deal continuum, including advisory and transaction fees which include brokerage fees on buying and selling assets, construction management fees on repositioning assets, and capital formation fees on capital contributed into our funds from third party clients. |

Strategy and Competitive Strengths

We manage and administer investment vehicles that allow investors to diversify their holdings into asset classes that would not be easily accessible to them otherwise. We typically distribute cash to fund investors where there is either: (i) sufficient distributable cash derived from the income of our investments (rents, etc.) or (ii) a capital event, such as a sale of an asset or a cash-out refinance. Caliber’s approach offers investors, and their wealth managers, products managed by a team aligned with their success. Our competitive strengths include:

| • | Extensive relationship and sourcing network. We leverage our relationships in order to source deals for our funds. In addition, our management has extensive relationships with major industry participants in each of the markets in which we currently operate. Their local presence and reputation in these markets enables them to cultivate key relationships with major holders of property inventory, in particular, financial institutions, throughout the real estate community. |

| • | Targeted market opportunities. We focus on business and investment-friendly markets that have a long-term trend of population growth and income improvement, in particular focus on Arizona, Colorado, Nevada and Utah. We generally avoid engaging in direct competition in over-regulated and saturated markets. |

| • | Structuring expertise and speed of execution. We believe we have developed a reputation of being able to quickly execute, as well as originate and creatively structure acquisitions, dispositions and financing transactions. We have experience in a variety of investment strategies, including direct property investments, joint ventures, participating loans and investments in performing and non-performing mortgages with the objective of long-term ownership. |

| • | Vertically integrated platform for operational enhancement. We believe in a hands-on approach to real estate investing and possess local expertise in brokerage, development management, and investment sales, which we believe enable us to invest successfully in select submarkets. |

| • | Focus on the middle market. We believe our focus on middle market opportunities provides attractive returns and offers our investors significant alternatives to active, equity investing. This focus has allowed us to offer a diversified range of alternative investment opportunities, particularly for accredited investors. |

| • | Risk protection and investment discipline. We underwrite our investments based upon a thorough examination of investment economics and a critical understanding of market dynamics and risk management strategies. We conduct an in-depth sensitivity analysis on each of our acquisitions. This analysis applies various economic scenarios that include, where appropriate, changes to rental rates, absorption periods, operating expenses, interest rates, exit values and holding periods. We use this analysis to develop our disciplined acquisition strategies. |

Our Growth Strategy

We aim to continue building wealth for our investors by expanding our business with the following strategies:

| · | Organic growth with our existing high net worth investor base. We estimate that we currently service less than 1% of the current high net worth investor base in the United States. Using our established direct sales method, we intend to attract additional high net worth individuals to expand our number of customers and our assets under management. |

| · | Expansion into additional distribution channels. We believe that many investors and their financial advisors are looking for investment opportunities outside of traditional debt and equities. We intend to expand our fundraising capabilities by offering Caliber’s products to a larger universe of investors by utilizing the distribution platforms of the registered investment adviser (RIA) network, as well as broker-dealers. |

| · | New funds and platforms. We intend to grow our AUM by expanding the number of available funds and platforms. We will look for complementary products and vehicles that utilize our existing vertically integrated infrastructure to allow us to continue to capture attractive risk-adjusted returns. These areas of investment could include private debt, venture capital and private equity. We expect these new funds and platforms will attract new investors, in addition to leveraging our existing investor base. |

| · | Accretive acquisitions. We also plan to evaluate potential accretive acquisition opportunities to further grow our business. These acquisitions could include opportunities to expand our distribution capabilities, product offerings or geographic reach. |

Human Capital Management

Caliber’s core principles of accountability, respect, and transparency are at the heart of who we are and how we operate. Our employees are integral to Caliber’s culture of transparency, integrity, professionalism, and excellence. Our team members adhere to these core principles leading to our continued success as an organization. Our professionals have decades of institutional experience in commercial, real estate, capital markets, alternative investments, and mergers and acquisitions. We give our employees the opportunities to develop and encourage them to collaborate to achieve success.

As of December 31, 2021, we had 72 employees. None of our employees are currently covered by a collective bargaining agreement.

Talent Acquisition, Development and Retention

We face intense competition for qualified personnel. We believe the talent of our employees, in association with our rigorous investment process, has supported our growth and investment performance over the past decade. We are focused on hiring, training, and developing the skills and careers of our people. We provide opportunities for growth and development for our team members and support their personal and professional goals in an effort to retain the most talented individuals.

We value diversity and inclusion amongst our team. The opportunities we provide in conjunction with our reputation is what makes us an attractive employer. We seek to retain and incentivize the performance of our employees through our compensation structure. We enter into non-competition and non-solicitation agreements with certain employees.

| 8 |

Compensation and Benefits

Our compensation strategy is designed to attract qualified talent, retain team members, and stay competitive within the talent market. Caliber continually evaluates our compensation structure to ensure it aligns with the market and continues to be an attractive component of joining our team. Compensation includes incentives for individual performance as well as overall company success in meeting goals. We believe these additional incentives encourage team members to perform at a high level.

We provide our team members with robust health and retirement offerings, as well as a variety of quality-of-life benefits, including flexible time-off, an employee assistance program at no cost to the team member, a company match for retirement, tuition reimbursement, and overall support for well-being and family planning resources.

Regulatory and Compliance Matters

Our businesses, as well as the financial services industry generally, are subject to extensive regulation, including periodic examinations, by governmental agencies and self-regulatory organizations or exchanges in the jurisdictions in which we operate relating to, among other things, anti-money laundering laws, and privacy laws with respect to client information, and some of our funds invest in businesses that operate in highly regulated industries. Each of the regulatory bodies with jurisdiction over us oversee many aspects of financial services, including the authority to grant, and in specific circumstances to revoke, permissions to engage in particular activities. Any failure to comply with these rules and regulations could expose us to liability and/or reputational damage. The SEC and various self-regulatory organizations, state securities regulators, and international securities regulators have in recent years increased their regulatory activities, including regulation, examination, and enforcement in respect of asset management firms. Additional legislation, increasing regulatory oversight of fundraising activities, changes in rules promulgated by self-regulatory organizations or exchanges or changes in the interpretation or enforcement of existing laws and rules may directly affect our mode of operation and profitability.

We intend to continue to conduct our operations so that neither we nor any subsidiaries we own nor ones we may establish will be required to register as an investment company under the Investment Company Act of 1940, as amended (“Investment Company Act”). The loss of our exclusion from regulation pursuant to the Investment Company Act could require us to restructure our operations, sell certain of our assets, or abstain from the purchase of certain assets, which could have an adverse effect on our financial condition and results of operations. If we were deemed an “investment company” under the Investment Company Act, applicable restrictions could make it impractical for us to continue our business as conducted and could have a material adverse effect on our business.

Beginning in the second quarter of 2020 and continuing through December 31, 2021, Caliber partnered with Patrick Capital Markets, LLC, a FINRA licensed entity, to provide managing broker-dealer services for the private fund offerings the Company is actively marketing. This additional layer of capital infrastructure was designed to support Caliber’s plan to grow an internal licensed sales team distributing our funds directly to both high-net-worth private clients and to institutions, such as registered investment advisers, who service those clients. The fees and costs associated with this arrangement included a managing broker-dealer fee ranging from 0.50% to 0.65% and a sales commission of 1.0%. These corresponding costs are partially offset by a reduction to the fee earned in our Caliber Securities contracts.

Beginning in January 2021, we formally engaged and transitioned our managing broker-dealer relationship to Tobin & Company Securities, LLC, a FINRA licensed entity. Our contract with Tobin provides for a managing broker-dealer fee ranging from 0.70% - 1.00% and a sales commission of 1.00%. These corresponding costs are partially offset by a reduction to the fee earned in our Caliber Securities contracts. Caliber believes its internal licensed sales and support team will enable the Company to bring its securities to market for an all-in cost of 4-5% of capital formed as compared to as much as 15% charged by some of our competitors.

Legal Proceedings

In August 2014, the Company entered into a consulting agreement with Mercadyne Advisors, LLC (“Mercadyne”) and 6831614 Manitoba Ltd. (“Manitoba”) (collectively, the “Consultants”). Per the agreement, the services to be provided by the Consultants were business consulting related services primarily focused on assisting the Company in accessing capital markets and designing, implementing, and completing a public offering. In exchange for the services, the agreement outlined the Consultants’ compensation to include a $25,000 monthly fee paid in cash and a contingently exercisable warrant to purchase a 15.00% equity interest in the Company for an aggregate exercise price of $1,000, exercisable upon the completion of a public offering. The agreement was amended in February 2015, for the purposes of amending the compensation to be a grant of equity rather than a warrant to purchase a 15.00% equity interest in the Company on a fully diluted basis as of the date of the amendment, for a price of $1,000, and to memorialize that all services required to be provided in connection with the agreement had been provided, although a public offering had not been completed. The agreement does not include a stated number of shares of common stock to be issued in exchange for the services provided. In March 2017, the Company and Mercadyne entered into a stock subscription agreement which finalized the number of shares of common stock to be issued to Mercadyne in connection with the consulting agreement and related amendment. The final number of shares issued to Mercadyne in connection with the agreement was 1,325,324. At the time of the settlement our liability was reduced by $1.1 million, with a corresponding increase to stockholders’ equity.

| 9 |

On January 27, 2020, Manitoba, and its President, filed a complaint in Maricopa County Superior Court in the State of Arizona against the Company and each of the members of its Board of Directors claiming among other things, breach of contract, breach of the implied covenant of good faith and fair dealing, unjust enrichment and fraud in the inducement, in connection with the above equity grant. The complaint sought damages in the amount of $10.9 million, but in no event less than $8.1 million, treble damages under the argument that the unissued shares are wages under Arizona law, or, alternatively, specific performance that the Company issue Manitoba 2,181,115 shares of Class A common stock, but in no event less than 1,625,324 shares. The complaint also sought fees, costs, interest and such other relief as the court deems just and proper. At the Company’s urging, a stipulation to place the entire matter into private, binding arbitration before the American Arbitration Association (“AAA”) in accord with the parties’ prior agreement documentation was executed by counsel for the parties. On March 27, 2020, the Court ordered the parties to AAA arbitration, to be commenced within thirty days of said order. The arbitration commenced and, on May 29, 2020, the respondents submitted their answering statement and counterclaim to the AAA which included the Company’s request to submit a dispositive motion on legal issues on which the Company believed it was likely to succeed as a matter of law. Following a March 29, 2021 initial preliminary hearing conference with the arbitration panel in which the panel approved the Company’s request to submit the dispositive motion, the Company indeed successfully obtained dismissal of four (4) of the alleged claims brought by the prior consultant, including the claim against it for “treble damages”, as well as dismissal of four (4) of the alleged respondent parties, and one of the claimant parties. None of the Company’s counterclaims have been dismissed. The arbitration hearing is presently scheduled for June 2022. The Company has engaged in and continues to be engaged in ongoing confidential settlement negotiations with Manitoba for settlement from all claims arising from or relating to the facts and circumstances underlying their complaint. Accordingly, in April 2022, management determined it was necessary to increase the accrual related to this matter to $3.2 million, as of December 31, 2021.

The Company believes that the claims against it are without merit and intends to vigorously defend its position. The Company also intends to vigorously pursue the counterclaims which it has alleged. The ultimate outcome of this legal matter cannot presently be determined or estimated, however, management believes the amount accrued is the best estimate of the ultimate potential loss in this matter. If all shares demanded further to the aforementioned complaint are ultimately issued to Manitoba, investors’ relative ownership interest will experience additional dilution.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes included elsewhere in this Annual Report on Form 1-K. The following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially from those discussed in these forward-looking statements. Unless otherwise indicated, latest results discussed below are as of December 31, 2021.

Overview

CaliberCos Inc., a Delaware corporation (collectively, the “Company”, “Caliber”, “we”, “our”, or “us”), was originally founded as Caliber Companies, LLC, an Arizona limited liability company, organized under the laws of Arizona, and commenced operations in January 2009. In 2014, the Company was reorganized as a Nevada corporation and in June 2018, we reincorporated in the state of Delaware.

Caliber builds wealth for our investor clients by creating, managing, and servicing proprietary products including middle-market investment funds, private syndications, and direct investments. Our funds include investment vehicles focused primarily on real estate, private equity, and debt facilities. We earn asset management fees calculated as a percentage of managed capital in our Funds and Offerings.

We believe that we provide investors attractive risk-adjusted returns by offering a balance of (i) structured offerings and ease of ownership, (ii) a pipeline of investments opportunities, primarily projects that range in value between $5 million and $50 million, and (iii) an integrated execution and processing platform. Our investment strategy leverages the local market intelligence and real-time data we gain from our operations to evaluate current investments, generate proprietary transaction flow, and implement various asset management strategies.

While we primarily act as an alternative asset manager, we also offer a full suite of support services and employ a vertically integrated approach to investment management. Our asset management activities are complemented with transaction and advisory services including development and construction management, acquisition and disposition expertise, and capital formation, which we believe differentiate us from other asset management firms. We believe our model allows us to acquire attractive projects, reduce operating costs, and deliver services to our funds that bolster net returns to investors.

Our operations are organized into three reportable segments for management and financial reporting purposes: Fund Management, Development, and Brokerage.

| 10 |

Fund Management — This segment represents our fund management activities along with back office and corporate support functions including accounting and human resources. It includes the activities of Caliber Services, LLC and its subsidiaries, (“Caliber Services”), who acts as an external manager of our funds, which have diversified investment objectives. It also includes the activities associated with Caliber Securities, LLC (“Caliber Securities”), a wholly-owned Arizona registered issuer-dealer, which generates fees from capital raising. We earn fund management fees for services rendered to each of the funds by Caliber Services as follows:

| • | Asset Management Fee. We receive an annual asset management fee equal to 1.0% - 1.5% of the non-affiliated capital contributions related to the ongoing management of the assets owned by the fund and the overall fund administration. The management fees are payable regularly, generally monthly, pursuant to our management agreement with each fund. |

| • | Carried Interest. We are entitled to an allocation of the income allocable to the limited partners or members of each fund for returns above accumulated and unpaid priority preferred returns and repayment of preferred capital contributions (the “Hurdle Rate”). Income earned with respect to our carried interest is recorded as Performance Allocations. Performance Allocations are an important element of our business and have historically accounted for a material portion of our revenues. |

| We typically receive a carried interest of 20% - 35%, depending on the fund, of all cash distributions from (i) the operating cash flow of each fund above the Hurdle Rate and (ii) the cash flow resulting from the sale or refinancing of any investments held by our funds after payment of the related fund’s investors unpaid priority preferred returns and Hurdle Rate. Our funds’ preferred returns range from 6% - 12%. |

| • | Financing Fee. We earn a fee upon the closing of a loan by our investment funds with a third-party lender. This is typically a fixed fee arrangement which approximates no more than 1% of the total loan and will not exceed 3% of the total loan after considering all other origination fees charged by lenders and brokers involved in the transaction. Financing fees are recorded under Transaction and Advisory Fees. |

| • | Set-Up Fee. We charge an initial one-time fee related to the initial formation, administration and set-up of the applicable fund. Set-up fees can be flat fees or a percentage of capital raised, typically 1.5% of capital raised or less. These fees are also known as Organizational and Offering expenses and are recorded under Transaction and Advisory Fees. | |

| • |

Capital Formation Fee. Through Caliber Securities, we earn non-affiliated fees from raising capital for our funds. Our contracts with our funds are typically fixed fee arrangements which approximate no more than 3.5% on capital raised. These fees are recorded under Transaction and Advisory Fees.

Based on the contractual terms of the relevant funds we manage, in addition to the fees noted above, Caliber is entitled to be reimbursed its expenses, that are not to exceed non-affiliated third party costs, related to services provided to the funds. |

Development — This segment represents our activities associated with managing and supervising third party general contractors in the remodeling, refurbishing and ground-up construction of the properties owned by our funds. Revenues generated by this segment are generally based on 4% of the total expected costs of the project. Caliber Development, LLC (“Caliber Development”), a wholly-owned subsidiary of Caliber Services, acts as either the construction or development manager on our funds’ projects.

Brokerage — This segment is involved in the buying and selling of all our funds’ assets. For the years ended December 31, 2021 and 2020, our brokerage segment completed approximately $55.2 million and $5.6 million in transactions generating approximately $0.9 million and $0.1 million of brokerage fees, respectively.

Trends Affecting Our Business

Our business is driven by trends which effect the following:

| 1.) | Capital formation: any trend which increases or decreases investors’ knowledge of real estate alternative investments, desire to acquire them, access to acquire them, and knowledge and appreciation of Caliber as a potential provider, will affect our ability to attract and raise new capital. Capital formation also drives investment acquisitions, which contribute to Caliber’s revenues. |

| 2.) | Investment acquisition: any trend which increases or decreases the supply of middle-market real estate projects, the accessibility of developments or development incentives, or enhances or detracts from Caliber’s ability to access those projects will affect our ability to generate revenue. Coincidentally, investment acquisitions, or the rights to acquire an investment, drive capital formation – creating a flywheel effect for Caliber. |

| 3.) | Project execution: any trend which increases or decreases the costs of execution on a real estate project, including materials pricing, labor pricing, access to materials, delays due to governmental action, and the general labor market, will affect Caliber’s ability to generate revenues. |

| 11 |

The prevailing trend in 2021 which continued to affect our business was the impact of the COVID-19 pandemic, which began having an effect in the first quarter of 2020, and which subsequently effected all three trends described above. COVID-19 continues to pose a threat to the health and economic wellbeing of the worldwide population and the overall economy in light of variants that seem to spread more easily than the original virus. While the equity markets have rebounded from their steep declines in March 2020 after the World Health Organization announced that infections of COVID-19 had become a pandemic, there is continued uncertainty as to the duration of the global health and economic impact caused by COVID-19 even with vaccines now available.

The extent to which the pandemic will affect our business, financial condition, results of operations, liquidity and prospects materially will depend on future developments, including the duration, spread and intensity of the pandemic, the duration of government measures to mitigate the pandemic and how quickly and to what extent normal economic and operating conditions can resume, all of which are uncertain and difficult to predict.

Our business depends in large part on our ability to raise capital from investors. Since our inception, we have continued to successfully raise capital into our funds with our total capital raised through December 31, 2021 exceeding $514 million. Our success at raising new capital into our funds is impacted by the extent to which new investors see alternative assets as a viable option for capital appreciation and/or income generation. Since our ability to raise new capital into our funds is dependent upon the availability and willingness of investors to direct their investment dollars into our products, our financial performance is sensitive in part to changes in overall economic conditions that affect investment behaviors. The demand from investors is dependent upon the type of asset, the type of return it will generate (current cash flow, long-term capital gains, or both) and the actual return earned by our fund investors relative to other comparable or substitute products. General economic factors and conditions, including the general interest rate environment and unemployment rates, may affect an investor’s ability and desire to invest in real estate. For example, a significant interest rate increase could cause a projected rate of return to be insufficient after considering other risk exposures. Additionally, if weakness in the economy emerges and actual or expected default rates increase, investors in our funds may delay or reduce their investments; however, we believe our approach to investing and the capabilities that Caliber manages throughout the deal cycle will continue to offer an attractive value proposition to investors.

For the year ended December 31, 2020, the potential adverse effects of COVID-19 resulted in an immediate and sharp slowdown in the U.S. economy which created uncertainty in the global economic outlook. This adversely affected our ability to raise money into our funds for that fiscal period. However, the global economy improved for the year ended December 31, 2021 and as a result capital raised into our funds rose to $114.0 million from $39.2 million for the year ended December 31, 2020. We are continuing to monitor the recovery in velocity of new investment capital into our funds and anticipate continuing to see the same trend for the remainder of the year.

While we have had historical successes, there can be no assurance that fundraising for our new and existing funds will experience similar success. If we were unable to raise such capital, we would be unable to collect capital raise fees or deploy such capital into investments, which would materially reduce our revenues and cash flow and adversely affect our financial condition.

| 12 |

We remain confident about our ability to find, identify, and source new investment opportunities that meet the requirements and return profile of our investment funds despite headwinds associated with increased asset valuations, competition and increased overall cost of credit. We continue to identify strategic acquisitions on off-market terms and anticipate that this trend will continue. We are at a point in our investment cycle where some of our funds have begun to exit significant parts of their portfolios while other are approaching a potential harvesting phase. We have complemented these cycles with other newer funds that will maintain management fees while providing continued sources of activity for our Development segment.

Acquiring new assets includes being able to negotiate favorable loans on both a short and long-term basis. We forecast and project our returns using assumptions about, among other things, the types of loans that we can expect the market to extend for a particular type of asset. This becomes more complex when the asset also requires construction financing. We may also need to refinance existing loans that are due to mature. Factors that affect these arrangements include the interest rate and economic environment, the estimated fair value of real property, and the profitability of the asset’s historical operations. These capital market conditions may affect the renewal or replacement of our credit agreements, some of which have maturity dates occurring within the next 12 months. Obtaining such financing is not guaranteed and is largely dependent on market conditions and other factors.

Key Financial Measures and Indicators

Our key financial measures are discussed in the following pages. Additional information regarding these key financial measures and our other significant accounting policies can be found in Note 2 – Summary of Significant Accounting Policies in the notes to our accompanying consolidated financial statements included herein.

Total Revenue

We generate the majority of our revenue from (i) asset management fees, (ii) performance allocations and (iii) advisory and transaction services. Included within our consolidated results, are the related revenues of certain consolidated Variable Interest Entities (“VIEs”). During 2021, we realigned our operating segments to better reflect the internal management of our business based on a change to the way our chief operating decision maker monitors performance, aligns strategies, and allocates resources. Refer to Note 2 – Summary of Significant Accounting Policies – Segment Information in the notes to our accompanying consolidated financial statements for additional disclosures.

Total Expenses

Total expenses include operating costs, general and administrative, marketing and advertising, depreciation. Included within our consolidated results, are the related expenses of certain consolidated VIEs.

Other (Income) Expenses

Other (income) expenses include interest expense and interest income.

Non-GAAP Measures

We present assets under management (“AUM”), EBITDA, and Adjusted EBITDA, which are not recognized financial measures under accounting principles generally accepted in the United States of America (“GAAP”), as supplemental disclosures because we regularly review these metrics to evaluate our funds, measure our performance, identify trends, formulate financial projections and make strategic decisions.

| 13 |

Business Segments

Assets Under Management. AUM refers to the assets we manage or sponsor. We monitor two types of information with regard to our AUM:

| i. | Capital AUM – we define this as the total debt and equity capital raised from accredited investors in our funds at any point in time. We use this information to monitor, among other things, the amount of ‘preferred return’ that would be paid at the time of a distribution. As our asset management fees are based on a percentage of capital raised, Capital AUM provides relevant data points for management to further calculate and predict future earnings. |

| ii. | Fair Value (“FV”) AUM – we define this is as the aggregate fair value of the real estate assets we manage. We value these assets quarterly to help make sale and hold decisions and to evaluate whether an existing asset would benefit from refinancing or recapitalization. This also gives us insight into the value of our carried interest at any point in time. We also utilize FV AUM to predict the percentage of our portfolio which may need development services in a given year, fund management services (such as refinance), and brokerage services. As we control the decision to hire for these services, our service income is generally predictable based upon our current portfolio AUM and our expectations for AUM growth in the year forecasted. |

EBITDA. EBITDA represents earnings before net interest expense, income taxes, depreciation, and amortization.

Adjusted EBITDA. Adjusted EBITDA represents earnings before net interest expense, income taxes, depreciation, amortization, impairment expense, loss on extinguishment of debt, severance payments, founder’s income tax reimbursement, and costs associated with the vesting of our Employee Stock Option Plan (“ESOP”) and certain cash and non-cash charges relates to legal and accounting costs associated with getting the Company prepared for filing its Reg A+ offering circular. We believe this view of Adjusted EBITDA offers a normalized view of the Company’s operating performance.

Although we believe we are utilizing generally accepted methodologies for our calculation of Capital AUM and FV AUM, it may differ from our competitors, thereby making these metrics non-comparable to our competitors.

When analyzing our operating performance, investors should use these measures in addition to, and not as an alternative for, their most directly comparable financial measure calculated and presented in accordance with GAAP. We generally use these non-GAAP financial measures to evaluate operating performance and for other discretionary purposes. We believe that these measures provide a more complete understanding of ongoing operations, enhance comparability of current results to prior periods and may be useful for investors to analyze our financial performance because they eliminate the impact of selected charges that may obscure trends in the underlying performance of our business. Because not all companies use identical calculations, our presentation of EBITDA and Adjusted EBITDA may not be comparable to similarly identified measures of other companies.

EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow for our discretionary use because they do not consider certain cash requirements such as tax and debt service payments. These measures may also differ from the amounts calculated under similarly titled definitions in our debt instruments, which amounts are further adjusted to reflect certain other cash and non-cash charges and are used by us to determine compliance with financial covenants therein and our ability to engage in certain activities, such as incurring additional debt and making certain restricted payments.

| 14 |

Results of Operations

Comparison of Years Ended December 31, 2021 and 2020

The following table and discussion provide insight into our consolidated results of operations for the years ended December 31, 2021 and 2020 (dollars in thousands):

| Years Ended December 31, | ||||||||||||||||

| 2021 | 2020 | $ Change | % Change | |||||||||||||

| Revenues | ||||||||||||||||

| Asset management fees | $ | 3,476 | $ | 2,754 | $ | 722 | 26.2 | % | ||||||||

| Performance allocations | 733 | 299 | 434 | 145.2 | % | |||||||||||

| Transaction and advisory fees | 5,666 | 3,415 | 2,251 | 65.9 | % | |||||||||||

| Consolidated funds – Hospitality revenue | 40,837 | 27,676 | 13,161 | 47.6 | % | |||||||||||

| Consolidated funds – Other revenue | 5,321 | 3,733 | 1,588 | 42.5 | % | |||||||||||

| Total revenues | 56,033 | 37,877 | 18,156 | 47.9 | % | |||||||||||

| Expenses | ||||||||||||||||

| Operating Costs | 9,685 | 10,972 | (1,287 | ) | (11.7 | )% | ||||||||||

| General and administrative | 5,307 | 2,751 | 2,556 | 92.9 | % | |||||||||||

| Marketing and Advertising | 1,536 | 1,086 | 450 | 41.4 | % | |||||||||||

| Depreciation and amortization | 83 | 151 | (68 | ) | (45.0) | % | ||||||||||

| Consolidated funds - Hospitality expenses | 55,999 | 44,718 | 11,281 | 25.2 | % | |||||||||||

| Consolidated funds – Other expenses | 5,532 | 4,509 | 1,023 | 22.7 | % | |||||||||||

| Total expenses | 78,142 | 64,187 | 13,955 | 21.7 | % | |||||||||||

| Other expenses (income), net | (1,653 | ) | (86 | ) | (1,567 | ) | 1822.1 | % | ||||||||

| Interest income | (1 | ) | (7 | ) | 6 | (85.7 | )% | |||||||||

| Interest expense | 712 | (672 | ) | 1,384 | (206.0) | % | ||||||||||

| Net Loss Before Income Taxes | (21,167 | ) | (25,545 | ) | 4,378 | (17.1 | )% | |||||||||

| Provision for (benefit from) income taxes | - | - | - | 0.0 | % | |||||||||||

| Net Loss | (21,167 | ) | (25,545 | ) | 4,378 | (17.1) | % | |||||||||

| Net loss attributable to noncontrolling interests | (20,469 | ) | (20,099 | ) | (370 | ) | 1.8 | % | ||||||||

| Net Income (Loss) Attributable to CaliberCos Inc. | $ | (698) | $ | (5,446 | ) | $ | 4,748 | (87.2) | % | |||||||

For the years ended December 31, 2021 and 2020, total revenues were $56.0 million and $37.9 million, respectively, representing a period-over-period increase of approximately 47.9%. This increase was primarily due to (i) an increase in revenues in our hospitality portfolio whose operations are beginning to recover from the impact of the COVID-19 pandemic which occurred throughout 2020, while lockdowns associated with virus containment continued to affect revenue levels in 2021, our properties generally are located in states that had re-opened quickly in late 2020; (ii) increased revenues in our single-family and multi-family real estate portfolios; and (iii) increased interest revenue in our lending fund compared to the prior comparative period.

For the years ended December 31, 2021 and 2020, total expenses were $78.1 million and $64.2 million, respectively, representing a period-over-period increase of 21.7%. The increase was primarily due to an increase in hospitality related expenses as operations responded to the measured recovery that started to appear in late 2020. The properties began expanded staffing levels and service offerings as occupancy and demand began to recover. In addition, the increase in total expenses is attributable to increased operating costs of our single-family and multi-family real estate portfolios as well as an increased interest expense related to our single-family and multi-family real estate portfolios. For the year ended December 31, 2021, notes payable related to these portfolios increased by approximately $15.7 million, primarily related to the consolidation of our Ironwood Fundco, LLC fund.

| 15 |

Segment Analysis

The following discussion is specific to our various segments for the years ended December 31, 2021 and 2020. Our segment information is presented in a format consistent with the information senior management uses to make operating decisions, assess performance and allocate resources.

For segment reporting purposes, revenues and expenses are presented on a basis that deconsolidates our consolidated funds. As a result, segment revenues are different than those presented on a consolidated basis in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) basis because these fees are eliminated in consolidation when they are derived from a consolidated fund. Furthermore, segment expenses are also different than those presented on a consolidated U.S. GAAP basis due to the exclusion of fund expenses that are paid by the consolidated funds.

Comparison of Years Ended December 31, 2021 and 2020

Fund Management

The following table presents our results of operations for our Fund Management segment (dollars in thousands):

| Years Ended December 31, | ||||||||||||||||

| 2021 | 2020 | $ Change | % Change | |||||||||||||

| Revenues | ||||||||||||||||

| Asset management fees | $ | 7,610 | $ | 5,316 | $ | 2,294 | 43.2 | % | ||||||||

| Performance allocations | 733 | 422 | 311 | 73.7 | % | |||||||||||

| Transaction and advisory fees | 3,240 | 1,278 | 1,962 | 153.5 | % | |||||||||||

| Total revenues | 11,583 | 7,016 | 4,567 | 65.1 | % | |||||||||||

| Expenses | ||||||||||||||||

| Operating costs | 7,725 | 7,105 | 620 | 8.7 | % | |||||||||||

| General and administrative | 5,084 | 2,796 | 2,288 | 81.8 | % | |||||||||||

| Marketing and advertising | 1,533 | 1,012 | 521 | 51.5 | % | |||||||||||

| Depreciation | 38 | 39 | (1 | ) | (2.6) | % | ||||||||||

| Total expenses | 14,380 | 10,952 | 3,428 | 31.3 | % | |||||||||||

| Other expenses (income), net | (1,090 | ) | (24 | ) | (1,066 | ) | 4441.7 | % | ||||||||

| Interest income | (104 | ) | (7 | ) | (97 | ) | 1385.7 | % | ||||||||

| Interest expense | 641 | (639 | ) | 1,280 | (200.3) | % | ||||||||||

| Net loss | $ | (2,244 | ) | $ | (3,266 | ) | $ | 1,022 | (31.3 | )% | ||||||

For the years ended December 31, 2021 and 2020, asset management fees were $7.6 million and $5.3 million, respectively, representing a period-over-period increase of 43.2%. The increase in our fees corresponds to the increase in total capital under management. Total capital under management at December 31, 2021 was approximately $301.0 million compared to $226.5 million at December 31, 2020.

For the years ended December 31, 2021 and 2020, performance allocations were $0.7 million and $0.4 million, respectively, representing a period-over-period increase of 73.7%. This increase was primarily due to an increase in our carried interest income. In 2021, profit share was generated by the sale by our investment funds of an office/flex building investment and a separate sale of a land investment. In 2020, performance allocations were primarily related to the final distribution of our profit share related to the completion of a 2019 sale by one of our investment funds of an investment in three apartment buildings.

For the years ended December 31, 2021 and 2020, transaction and advisory fees were $3.2 million and $1.3 million, respectively, representing a period over period increase of 153.5%. For the year ended December 31, 2021, we raised approximately $114.0 million compared to approximately $39.2 million for the year ended December 31, 2020.

For the years ended December 31, 2021 and 2020, operating costs were $7.7 million and $7.1 million, respectively, representing a period-over-period increase of 8.7%. This increase was primarily due to an increase corporate payroll costs resulting from increased headcount.

For the years ended December 31, 2021 and 2020, general and administrative costs were $5.1 million and $2.8 million, respectively, representing a period-over-period increase of 81.8%. This increase was primarily due to an increase in legal reserves in 2021 based on continued development of current litigation matters of the Company.

For the years ended December 31, 2021 and 2020, marketing and advertising was $1.5 million and $1.0 million, respectively, representing a period-over-period increase of approximately 51.5%. During the year ended December 31, 2021, we incurred higher costs associated with marketing the closing of the Company’s Reg A+ capital raise which closed at the end of February 2021.

For the years ended December 31, 2021 and 2020, other expenses (income), net was $1.1 million and $0.02 million, respectively. This increase is primarily due to employee retention credits received in 2021 under the CARES Act for which the Company did not qualify in 2020.

| 16 |

For the years ended December 31, 2021 and 2020, interest expense was $0.6 million and $(0.6) million, respectively, representing a period-over-period increase of 200.3%. In 2020, we received approval from the Small Business Administration for full forgiveness of our Payroll Protection Program loan totaling $1.4 million.

Development

The following table presents our results of operations for our Development segment (dollars in thousands):

| Years Ended December 31, | ||||||||||||||||

| 2021 | 2020 | $ Change | % Change | |||||||||||||

| Revenues | ||||||||||||||||

| Transaction and advisory fees | $ | 3,211 | $ | 4,434 | $ | (1,223 | ) | (27.6) | % | |||||||

| Total revenues | 3,211 | 4,434 | (1,223 | ) | (27.6 | )% | ||||||||||

| Expenses | ||||||||||||||||

| Operating costs | 2,659 | 4,541 | (1,882 | ) | (41.4) | % | ||||||||||

| General and administrative | 162 | 65 | 97 | 149.2 | % | |||||||||||

| Marketing and advertising | 3 | 55 | (52 | ) | (94.5 | )% | ||||||||||

| Total expenses | 2,824 | 4,661 | (1,837 | ) | (39.4 | )% | ||||||||||

| Other expenses (income), net | (53 | ) | 1 | (54 | ) | (5400.0 | )% | |||||||||

| Net Income (loss) | $ | 440 | $ | (228 | ) | $ | 668 | (293.0) | % | |||||||

For the years ended December 31, 2021 and 2020, segment revenues were $3.2 million and $4.4 million, respectively, representing a period-over-period decrease of 27.6%. This was due to the completion of our Tucson Convention Center hotel the Doubletree by Hilton in March 2021.

For the years ended December 31, 2021 and 2020, operating costs were $2.7 million and $4.5 million, respectively, representing a period-over-period decrease of 41.4%. This decrease was due to the decrease in revenues over the same period and recovery in 2021 from the increased operating costs experienced in 2020 due to the effects of the pandemic where supply and labor shortages caused inefficiencies in our job execution and increased labor costs, respectively.

| 17 |

Brokerage

The following table presents our results of operations for our Brokerage segment (dollars in thousands):

| Years Ended December 31, | ||||||||||||||||

| 2021 | 2020 | $ Change | % Change | |||||||||||||

| Revenues | ||||||||||||||||

| Transaction and advisory fees | $ | 1,198 | $ | 747 | $ | 451 | 60.4 | % | ||||||||

| Total revenues | 1,198 | 747 | 451 | 60.4 | % | |||||||||||

| Expenses | ||||||||||||||||

| Operating costs | 259 | 636 | (377 | ) | (59.3) | % | ||||||||||

| General and administrative | 61 | 3 | 58 | 1933.3 | % | |||||||||||

| Marketing and advertising | - | 18 | (18 | ) | (100.0 | )% | ||||||||||

| Depreciation and amortization | 45 | 110 | (65 | ) | (59.1) | % | ||||||||||

| Total expenses | 365 | 767 | (402 | ) | (52.4 | )% | ||||||||||

| Other expenses (income), net | (510 | ) | - | (510 | ) | 100.0 | % | |||||||||

| Interest income | - | - | - | 0.0 | % | |||||||||||

| Interest expense | 115 | 202 | (87 | ) | (43.1) | % | ||||||||||

| Net Income (loss) | $ | 1,228 | $ | (222 | ) | $ | 1,450 | (653.2 | )% | |||||||

For the years ended December 31, 2021 and 2020, segment revenues were $1.2 million and $0.7 million, respectively, representing an increase of 60.4%. In 2021, we completed the sale of our Treehouse apartment complex in Tucson, Arizona which sold for $23.0 million and our Fiesta Tech office/flex building in Gilbert, Arizona for $8.3 million.

For the years ended December 31, 2021 and 2020, other expenses (income) were $0.5 million and $0, respectively. In 2021 we sold the remaining four single-family homes owned by Caliber Auction Homes, which included two single family homes which were sold to related parties, previously held as investments in real estate for $1.9 million, resulting in a gain on the dispositions of $0.5 million.

Investment Valuations

The investments that are held by our funds are generally considered to be illiquid and have no readily ascertainable market value. We value these investments based on our estimate of their fair value as of the date of determination. We estimate the fair value of our fund’s investments based on a number of inputs built within forecasting models which are either developed by a third party or by our internal finance team. The models generally rely on discounted cash flow analysis and other techniques and may include independently sourced market parameters. The material estimates and assumptions used in these models include the timing and expected amounts of cash flows, income and expenses for the property, the appropriateness of discount rates used, overall capitalization rate, and, in some cases, the ability to execute, estimated proceeds and timing of expected sales and financings. The majority of our assets utilize the income approach to value the property. Where appropriate, management may obtain additional supporting evidence of values from methods generally utilized in the real estate investment industry, such as appraisal reports and broker price opinion (“BPO”) reports.

As discussed elsewhere in this document, we have experienced adverse effects related to COVID-19 on our assets. It is unclear whether the effects of COVID-19 will have a lasting and prolonged effect on asset values over the long term.

With respect to the underlying factors that led to the change in fair value in the current year, we identify assets that are undervalued and/or underperforming at the time of acquisition. Such assets generally undergo some form of repositioning soon after our acquisition in order to help drive increased appreciation and operating performance. Once the repositioning is complete, we focus on increasing the asset’s net operating income, thereby further increasing the value of the asset. Making below-market acquisitions, adding value through development activities, and increasing free cash flow with proper management all represent a material component to our core business model. Despite those efforts, the impacts of COVID-19 have appeared in the values of our assets. While we believe that COVID-19 will not have a permanent effect on the long-term value of our assets, there can be no assurance that such outcome will occur.

A unique feature of Caliber’s funds is the discretion given to Caliber’s management team to decide when to sell assets and when to hold them. We believe this discretion allows Caliber to avoid selling properties that, while their business plan may have matured, the market will not pay an attractive price in the current environment. Avoiding selling at a time of disruption, such as all of 2020, is critical to preserving the value of our assets, our carried interest, our ongoing revenues, and our clients’ capital. We believe the disruption caused by COVID-19 may negatively affect our competitors, who may have a more traditional model with fixed, required, liquidation dates, which in turn may offer Caliber attractive investment opportunities. While this is managements expectation, there can be no assurance these outcomes will occur.

| 18 |

Assets Under Management

The following tables summarize Capital AUM and FV AUM for our investment fund portfolios as of December 31, 2021 and 2020:

Capital AUM

| December 31, | ||||||||

| 2021 | 2020 | |||||||

| Real Estate | ||||||||

| Hospitality | $ | 100,887 | $ | 89,730 | ||||

| Residential | 45,643 | 46,297 | ||||||

| Commercial | 65,176 | 35,500 | ||||||

| Total Real Estate | 211,706 | 171,527 | ||||||

| Credit(1) | 43,849 | 51,734 | ||||||

| Other(2) | 45,464 | 3,225 | ||||||

| Total | $ | 301,019 | $ | 226,486 | ||||

| (1) | Credit Capital AUM represents loans made to Caliber’s investment funds by our Diversified credit fund. |

| (2) | Other Capital AUM represents undeployed capital held in our Diversified funds. |

FV AUM

| December 31, | ||||||||

| 2021 | 2020 | |||||||

| Real Estate | ||||||||

| Hospitality | $ | 264,800 | $ | 223,800 | ||||

| Residential | 90,763 | 83,635 | ||||||

| Commercial | 169,712 | 105,432 | ||||||

| Total Real Estate | 525,275 | 412,867 | ||||||

| Credit(1) | 43,849 | 51,734 | ||||||

| Other(2) | 45,464 | 3,225 | ||||||

| Total | $ | 614,588 | $ | 467,826 | ||||

| (1) | Credit FV AUM represents loans made to Caliber’s investment funds by our Diversified credit fund. |

| (2) | Other FV AUM represents undeployed capital held in our Diversified funds. |

The tables below illustrate the annual activity on the portfolio investments of our funds as of December 31, 2021 and 2020:

| 19 |

Capital AUM

| December 31, | ||||||||

| 2021 | 2020 | |||||||

| Beginning of year | $ | 226,486 | $ | 204,755 | ||||

| Originations | 91,246 | 31,903 | ||||||

| Redemptions | (16,713 | ) | (10,172 | ) | ||||

| End of Year | $ | 301,019 | $ | 226,486 | ||||

FV AUM

| December 31, | ||||||||

| 2021 | 2020 | |||||||

| Beginning of year | $ | 467,826 | $ | 395,816 | ||||

| Assets acquired | 37,008 | 4,300 | ||||||

| Construction/renovation | 33,026 | 55,845 | ||||||

| Market appreciation/depreciation, net | 71,067 | 9,898 | ||||||

| Assets sold | (39,803 | ) | (1,258 | ) | ||||

| Other(1) | 45,464 | 3,225 | ||||||

| End of Year | $ | 614,588 | $ | 467,826 | ||||

(1) Other FV AUM represents undeployed capital held in our Diversified funds.

EBITDA and Adjusted EBITDA

We believe that EBITDA and Adjusted EBITDA provide a more complete understanding of ongoing operations, enhance comparability of current results to prior periods and may be useful for investors to analyze our financial performance because they eliminate the impact of selected charges that may obscure trends in the underlying performance of our business.

The following table presents a reconciliation of net income (loss) to EBITDA and Adjusted EBITDA for periods presented (in thousands):

| Years Ended December 31, | ||||||||

| 2021 | 2020 | |||||||

| Net Income (Loss) (1) | $ | (576 | ) | $ | (3,716 | ) | ||

| (2) Add: | ||||||||

| Interest expense | 756 | 970 | ||||||

| Depreciation expense | 83 | 149 | ||||||

| EBITDA | 263 | (2,597 | ) | |||||

| (2) Add: | ||||||||

| Share buy back | 317 | 291 | ||||||

| ESOP | 24 | - | ||||||

| Severance payments | - | 138 | ||||||

| Form 1-A costs | 943 | 878 | ||||||

| Adjusted EBITDA | $ | 1,547 | $ | (1,290 | ) | |||

(1) Net Income (Loss) is presented on a basis that deconsolidates our consolidated funds and eliminates noncontrolling interest and includes only those amounts attributable to CaliberCos Inc. and its wholly-owned subsidiaries. See Note 16 – Segment Reporting for additional disclosures on our segment accounting policies and the required GAAP reconciliation to the consolidated statement of operations.

(2) Form 1-A costs include direct costs related to our Reg A+ offering such as legal and accounting advisor fees, printing costs, and advertising costs.

| 20 |

Liquidity and Capital Resources